How to Dispute a Mitchell Total Loss Vehicle Valuation Report

When an insurance company decides to deem a vehicle a total loss because the extent of damage exceeds the repair cost you’re supposed to be made whole for the loss right? One would think that is the case.

The truth is that insurance companies try to pay as little as possible. It does not matter if you’re in good hands, have a good neighbor, or are covered my an animated gecko… Insurance companies systematically under pay claims, that is essentially their business plan; collect high premiums and pay out as little as possible. But that’s not what you’re told when you apply for a policy, you’re told you’re in good hands…

When you speak with an insurance adjuster after the car is deemed a total loss, you’re ensured that you will receive a fair settlement, since that’s what you signed up for. Adjusters are trained to essentially sell you on the idea that their offer is more than fair. Should you trust the person that owes you money?? Absolutely not. That adjuster will usually make an offer that is only just enticing enough for you not to think twice. This is why you should always seek a second opinion when dealing with a totaled car.

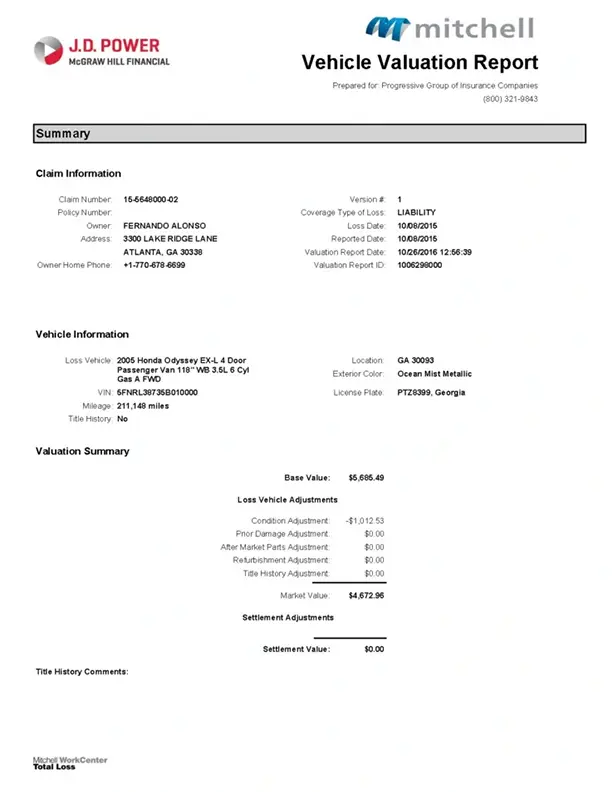

After the car is deemed total you should receive a settlement offer along with an appraisal or valuation to support that offer. Incase you’re hesitant, the adjuster will ensure you that the value was appraised by a third party that is unbiased and complete millions of valuations each year. The second most common valuation company is Mitchell. The issue is that Mitchell relies on most of the major insurance companies as their main source of revenue. So is Mitchell really unbiased? Nope. Not only is Mitchell biased in the insurance carriers favor but they allow the insurance adjuster make certain adjustments to the totaled car value. This includes deductions for condition, options, and more importantly the comparable vehicles listed in the report. The formulas for condition and mileage adjustments are so complicated that Pythagoras himself wouldn’t be able to make any sense out of.

So why would one trust this “independent valuation”? You shouldn’t. Back to the point of this article. How to fight the Mitchell Market Valuation Report.

First, dissect the report. Review the options the totaled vehicle had. Are all the options listed on the report. Are all, if any aftermarket accessories accounted for? Do the conditioning adjustments reflect the totaled car? Is the mileage listed correctly?

Next, review the comparable vehicles. Research the listed cars being compared to the totaled car. Are they similar? Are they in a similar or better condition? Are they clean title vehicles?

Third, confront the adjuster. If the report seems off, gather the discrepancies and present them in writing to the insurance handling the total loss portion of the claim. Usually the adjust may make a minor adjustment because they know the report is biased or they will be defensive and make it seem like you do not have a choice but take what they give you for the totaled car.

If all efforts fail get a second opinion! If the adjuster is unresponsive or defensive contact Auto Claim Consultants. We will review the Mitchell Market Valuation Report complimentary. If we think your totaled car is worth more we will explain the options you have, one of which is hiring us as an independent appraiser to obtain the correct value for the totaled car.