Maximizing Your Compensation: Understanding and Pursuing a Diminished Value Claim

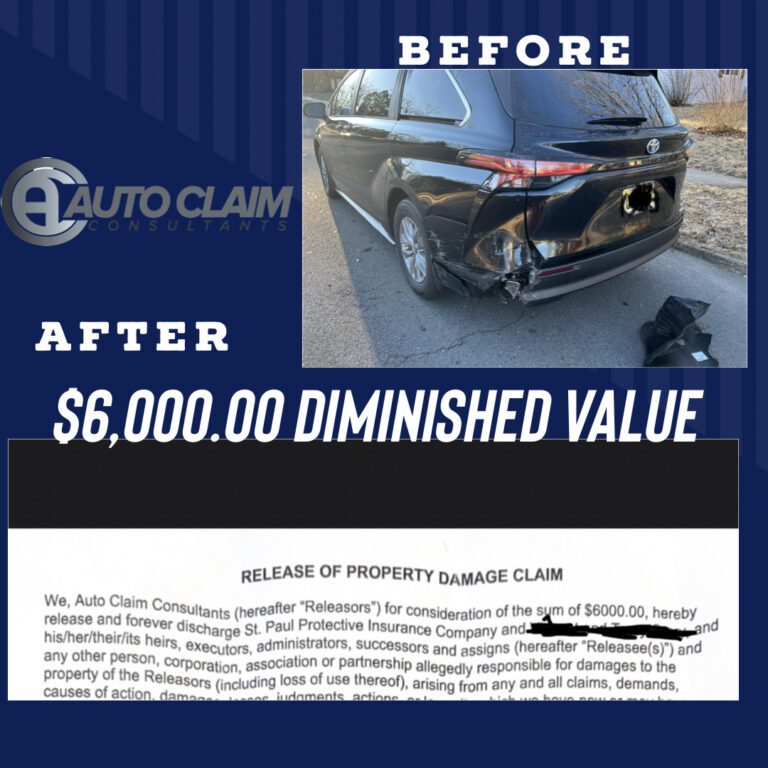

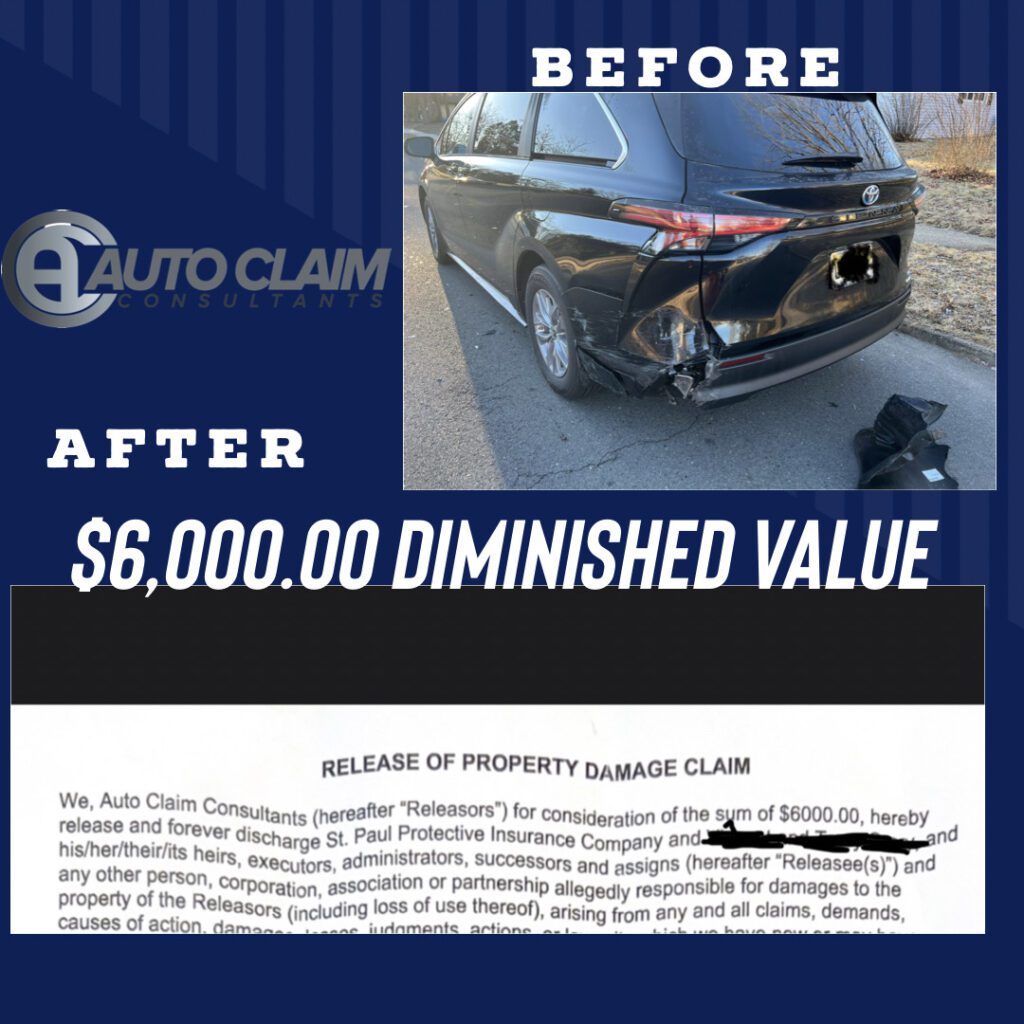

Being involved in an accident can be a stressful experience, and the financial impact of vehicle damage can be significant. Recently, our client in New Jersey found themselves in this unfortunate situation after being struck by an individual insured with Traveler’s Insurance. However, through the pursuit of a diminished value claim, we were able to secure a substantial settlement of $6,000, on top of the $13,314.00 for the vehicle damage. In this blog post, we will explore the concept of a diminished value claim and highlight the importance of understanding and pursuing it to maximize your compensation.

Understanding Diminished Value:

Diminished value refers to the reduction in a vehicle’s market value after it has been involved in an accident and subsequently repaired. Even with expert repairs, potential buyers may perceive a diminished value due to the vehicle’s accident history. Recognizing this loss in value, insurance companies are often responsible for compensating claimants for this difference.

The Back-and-Forth with the Adjuster:

Following the accident, our client engaged in discussions with Traveler’s Insurance adjuster to negotiate fair compensation. It is important to note that insurance adjusters may initially offer lower settlements to minimize their company’s payouts. However, armed with our expertise and the knowledge of our client’s rights, we persevered to ensure our client received proper compensation.

Reaching an Agreement:

Through persistent negotiations, we were able to convince Traveler’s Insurance adjuster to do the right thing. Eventually, we reached an agreement on a diminished value settlement of $6,000, in addition to the $13,314.00 for the vehicle damage. This resolution highlights the importance of tenacity and a thorough understanding of diminished value claims when dealing with insurance companies.

The Power of Pursuing a Diminished Value Claim:

By pursuing a diminished value claim, our client was able to maximize their compensation and recover the true value of their vehicle. This additional settlement not only accounts for the repair costs but also addresses the potential financial loss due to the vehicle’s diminished market value. It is crucial for claimants to be aware of their right to pursue a diminished value claim and to advocate for fair compensation.

Conclusion:

Being involved in an accident can result in both physical and financial repercussions. Understanding the concept of a diminished value claim and asserting your rights can help you recover the full compensation you deserve. In our client’s case, pursuing a diminished value claim allowed us to secure an additional $6,000 settlement on top of the vehicle damage costs. Don’t settle for less than you are entitled to—educate yourself on diminished value claims and seek professional assistance to ensure you receive fair compensation for the true value of your vehicle.