Maximizing Your Settlement: Unveiling the Truth Behind a Liberty Mutual Total Loss Settlement

Maximizing Your Settlement: Unveiling the Truth Behind Liberty Mutual Total Loss Settlement

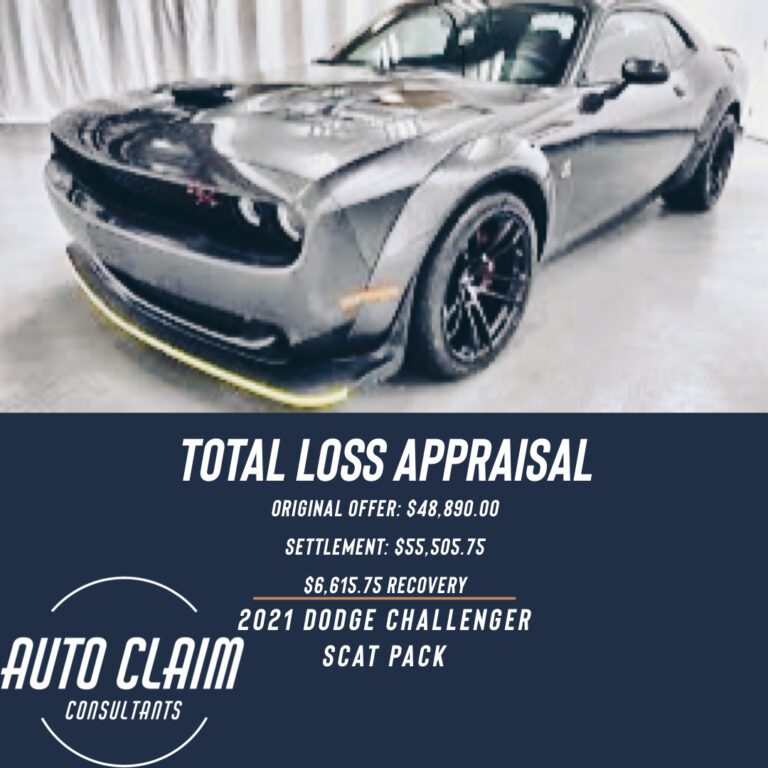

When it comes to dealing with insurance companies after a total loss, it’s essential to ensure you receive fair compensation for your valuable assets. Recently, our client in Philadelphia found themselves in a challenging situation when Liberty Mutual, in collaboration with CCC One, attempted to lowball their offer for a stolen 2021 Dodge Challenger Scat Pack Wide Body. By invoking their right to appraisal and enlisting the assistance of Auto Claim Consultants, we successfully secured a settlement that was $6,615.00 more than the initial offer. In this blog post, we will delve into the details of the case, emphasizing the importance of understanding the true value of your vehicle and the benefits of seeking professional assistance during the Liberty Mutual total loss settlement process.

Unveiling the Undervaluation:

Our client faced an undervaluation challenge when CCC One appraised their stolen 2021 Dodge Challenger Scat Pack Wide Body as a non-wide body model. Anyone familiar with these cars knows that the wide body variant holds significant value and is highly sought after in the market. Recognizing this discrepancy, we knew it was crucial to fight for our client’s rights and ensure they received the correct valuation for their vehicle.

The Power of the Right to Appraisal:

To address the inaccurately low offer, we invoked our client’s right to appraisal. This crucial step allowed us to challenge the initial valuation and present compelling evidence to support the true value of the wide body variant. By involving independent experts, we ensured a fair evaluation process that accurately reflected the worth of our client’s vehicle.

Securing the Correct Value:

Through our expertise and comprehensive presentation of evidence, we successfully convinced Liberty Mutual to recognize the true value of the stolen vehicle. Our client received a settlement that not only covered the actual value of the wide body Challenger but also exceeded the amount they had initially paid for the vehicle a year prior. This outcome emphasizes the significance of seeking professional assistance, as it can lead to a substantial increase in the settlement amount and ensure that you are adequately compensated.

The Benefits of Hiring Auto Claim Consultants:

This case exemplifies the advantages of hiring Auto Claim Consultants to navigate the total loss settlement process. With our in-depth knowledge and experience, we were able to uncover the undervaluation, invoke the right to appraisal, and secure a significantly higher settlement for our client. When faced with complex situations involving insurance companies like Liberty Mutual, having a dedicated team by your side can make all the difference in achieving a fair and just resolution.

Conclusion:

Dealing with insurance companies after a total loss can be a daunting task. However, by understanding your rights and enlisting the expertise of professionals like Auto Claim Consultants, you can maximize your settlement. In our client’s case, challenging Liberty Mutual’s initial undervaluation resulted in a settlement that exceeded expectations, providing our client with $6,615.00 more than the original offer. Don’t settle for less than what you deserve—trust in the power of accurate valuation and professional assistance to ensure fair compensation during the Liberty Mutual total loss settlement process.