Allstate Total Loss: A Comprehensive Guide

When you experience a car accident, and your vehicle is deemed a total loss, the process of dealing with insurance claims can be overwhelming. Understanding how total loss policies work is crucial to ensuring you receive the best possible outcome. This guide will provide you with a comprehensive overview of Allstate total loss policies, how they work, and how you can maximize your claim with the help of a professional Allstate total loss adjuster.

For any Allstate total loss claims, you can contact Allstate directly at 1-800-ALLSTATE.

Want to Maximize Your Total Loss Claim Amount?

Understanding Allstate Total Loss

When a vehicle is deemed a total loss, it means that the cost to repair the vehicle exceeds a certain percentage of its value, as determined by the insurance company. Allstate typically considers a vehicle a total loss if the repair costs exceed 70% of its market value. This percentage can vary based on state regulations and specific policy details.

Determining Total Loss

Allstate, like most insurers, uses a formula to determine whether a vehicle is a total loss. This includes evaluating the damage, estimating repair costs, and comparing these costs to the vehicle’s ACV. If the repair costs surpass the threshold set by Allstate, the vehicle will be considered a total loss.

Actual Cash Value (ACV)

The ACV is the amount your car is worth at the time of the loss. It considers factors such as the vehicle’s age, condition, mileage, and market value. Allstate uses this value to determine the payout for a total loss claim.

How Allstate Determines Total Loss

Allstate uses a combination of factors to determine whether a vehicle is a total loss:

- Vehicle Inspection: An Allstate total loss adjuster inspects the vehicle to assess the extent of the damage.

- Repair Costs: Estimates are gathered from approved repair shops to determine the cost to fix the vehicle.

- Market Value: Allstate assesses the pre-accident market value of the vehicle using tools like Kelley Blue Book, NADA guides, and other industry standards.

- Salvage Value: The potential salvage value of the vehicle is also considered, which can offset the total loss payout.

If the repair and associated costs exceed the threshold set by Allstate, the vehicle is declared a total loss.

Filing an Allstate Total Loss Claim

Filing a total loss claim with Allstate involves several steps:

1. Report the Claim

Contact Allstate as soon as possible after the accident. You can reach the Allstate total loss claims department by calling 1-800-ALLSTATE. Provide them with all necessary information about the accident and the extent of the damage.

2. Vehicle Inspection

An Allstate total loss adjuster will inspect your vehicle to assess the damage. This inspection can be done at a repair shop, your home, or another location convenient for you.

3. Claim Evaluation

Allstate will evaluate the cost of repairs versus the vehicle’s market value. If the vehicle is deemed a total loss, Allstate will calculate the payout based on the market value of the vehicle minus any applicable deductibles.

4. Settlement Offer

You will receive a settlement offer from Allstate. This offer will detail the amount they are willing to pay for the total loss of your vehicle. It’s crucial to review this offer carefully and understand how it was calculated.

5. Accepting or Negotiating the Offer

You can either accept the offer or negotiate if you believe the payout is insufficient. Providing additional evidence of your vehicle’s value or repair costs can support your case.

6. Finalizing the Claim

Once you agree to a settlement, Allstate will finalize the claim and issue a payment. The process may include transferring the title of your vehicle to Allstate if they take possession of the totaled vehicle.

Maximizing Your Allstate Total Loss Claim

To maximize your Allstate total loss claim, it is crucial to document every detail of the accident and your vehicle’s condition by taking photos, keeping records of repairs and maintenance, and gathering all relevant paperwork. Understanding your insurance policy is equally important, so be sure to know your coverage limits, deductibles, and any clauses that could impact your claim. If the settlement offer seems inadequate, don’t hesitate to negotiate by providing evidence such as recent sales of similar vehicles or additional documentation of your vehicle’s value.

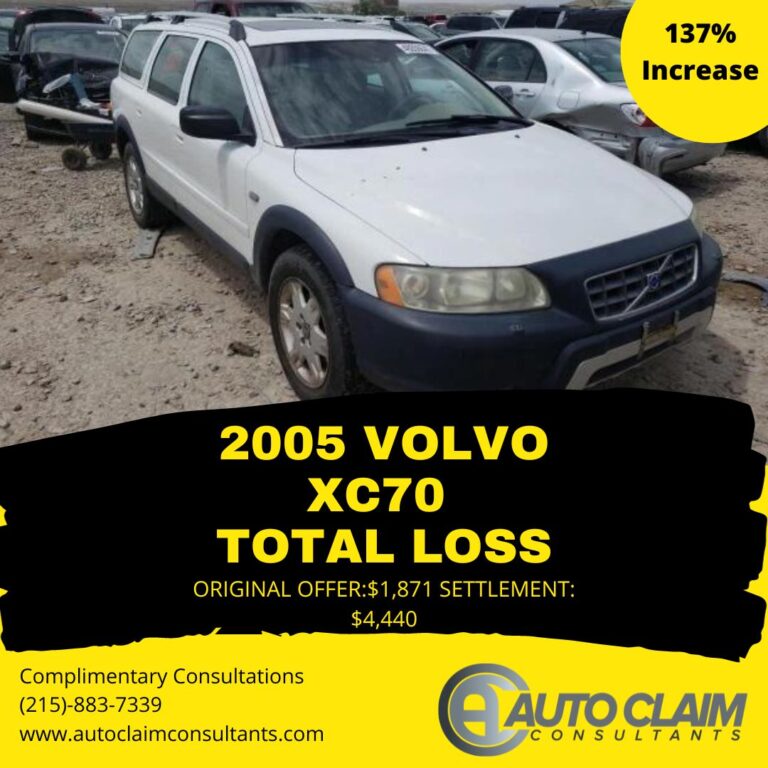

Auto Claim Consultants: Your Advocate in Total Loss Claims

Navigating a total loss claim can be daunting, especially when trying to ensure you receive a fair payout. This is where Auto Claim Consultants come in. Our team of independent auto appraisers specializes in helping individuals achieve the highest payout possible from their diminished value and total loss claims.

As experts in the field, we understand the intricacies of Allstate total loss policies and how to effectively negotiate with Allstate total loss adjusters. We work tirelessly to ensure that you receive a fair and accurate valuation for your vehicle, maximizing your total loss settlement.

Contact an Allstate Total Loss Adjuster Today

Dealing with a total loss can be stressful and overwhelming, but understanding Allstate’s total loss policies and knowing your rights can help you navigate the process more effectively. If you’ve totaled your vehicle and are seeking assistance from an Allstate total loss adjuster, Auto Claim Consultants are here to help. Our independent appraisers are dedicated to securing the highest possible payout for your claim.

Contact us today to get started or to learn more about how we can assist you with your Allstate total loss claim. Don’t settle for less – let us help you achieve the compensation you deserve.

FAQs

What is a total loss?

A total loss occurs when the cost to repair a vehicle exceeds a certain percentage of its market value, making repairs impractical. For Allstate, this threshold is typically around 70% of the vehicle’s market value, but it can vary based on state regulations and specific policy details.

How does Allstate determine if my vehicle is a total loss?

Allstate considers several factors, including the extent of the damage, repair costs, the vehicle’s pre-accident market value, and its potential salvage value. If the repair costs exceed the set threshold, the vehicle is declared a total loss.

What should I do immediately after my vehicle is declared a total loss?

Contact Allstate as soon as possible to report the claim. You can reach their total loss claims department at 1-800-ALLSTATE. Provide all necessary information about the accident and the damage to your vehicle.

How is the payout amount calculated for a total loss?

The payout amount is based on the pre-accident market value of your vehicle, determined using industry-standard valuation tools. Allstate will subtract any applicable deductibles from this amount to arrive at the final settlement offer.

Can I negotiate the settlement offer from Allstate?

Yes, you can negotiate the settlement offer if you believe it is insufficient. Providing additional evidence of your vehicle’s value, such as recent repair receipts or independent appraisals, can help support your case for a higher payout.

What if I disagree with Allstate’s valuation of my vehicle?

If you disagree with the valuation, you can dispute it by providing additional documentation, such as recent repair receipts, maintenance records, or an independent appraisal. This can help you negotiate for a higher payout.

What documents do I need to provide for my total loss claim?

You’ll need to provide a police report (if applicable), your insurance policy details, a copy of your vehicle’s title, and any relevant repair estimates or receipts. Additional documents may be required depending on your specific situation.