Total Loss Settlements: A Guide to Maximizing Your Payout

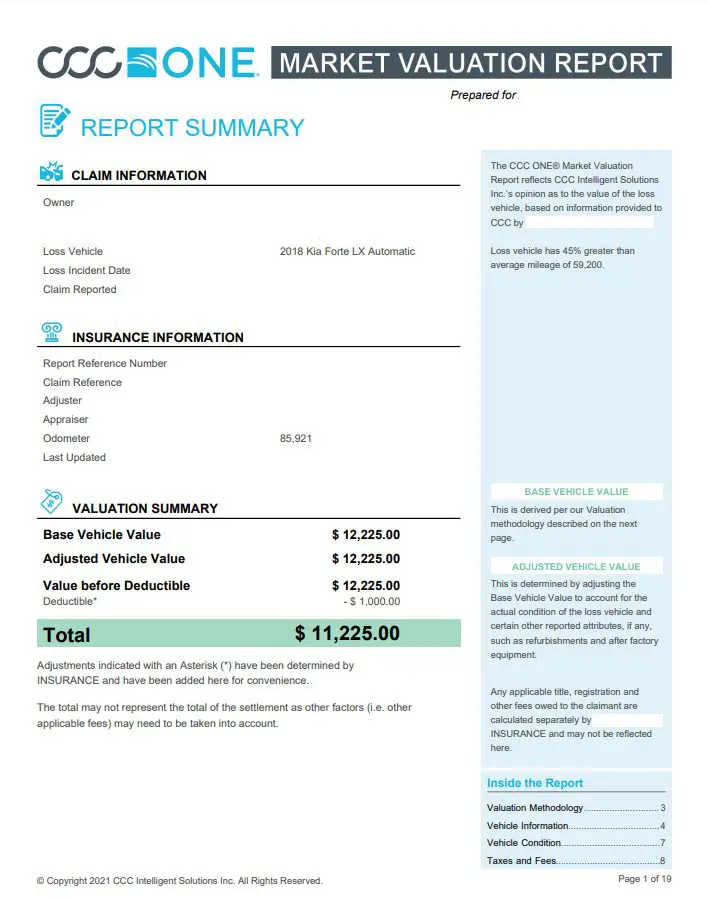

When your car is deemed a total loss following an accident, it means that the cost of repairing the vehicle surpasses its actual cash value (ACV). At this juncture, insurers typically present an initial settlement offer based on their ACV assessment. However, policyholders possess the power to negotiate for a more favorable payout.

A crucial step in this process is conducting independent research to determine the true value of your vehicle. Resources such as Kelley Blue Book and J.D. Power offer valuable insights into your car’s worth. Compare details such as make, model, year, features, condition, and mileage against the listed value ranges. Should you discover evidence supporting a higher value, like images of customized features or recent substantial repairs, these can bolster your negotiation position.

In instances where the initial offer from the insurer falls short based on your independent ACV findings, it’s prudent to provide documented proof of the higher value and courteously request a reevaluation. Engaging in direct negotiations with the adjuster should be your initial step, emphasizing discrepancies in their valuation.

Should negotiations hit an impasse, seeking an appraisal becomes a strategic move. This involves obtaining a third-party assessment of the vehicle’s fair market value, independent from the insurer. The prospect of additional time and expenses might prompt insurers to raise their offers to avoid an appraisal. Moreover, the appraisal process can serve as tangible evidence that the insurer undervalued your total loss.

Maintaining a composed demeanor while backed by thorough research is pivotal during negotiations. Remember, your insurer is obligated to ensure you receive fair compensation, so it’s essential to assert yourself if their valuation proves inadequate. If needed, consulting with an attorney can provide expert guidance on maximizing your total loss settlement post-accident.

In conclusion, when facing the aftermath of a total loss declaration, understanding the intricacies of negotiation is paramount. Armed with research, evidence, and persistence, you can secure a settlement that truly reflects the value of your vehicle.

Auto Claim Consultants is here to help with your total loss. Our results speak for themselves.

Contact us below for a free consultantion!

Get a Complimentary Claim Review Today!

Please fill out the required information and attach the insurance carrier’s appraisal. We will review it within 24-48 hours and let you know how we can help.