CCC and State Farm:Navigating a Total Loss Claim

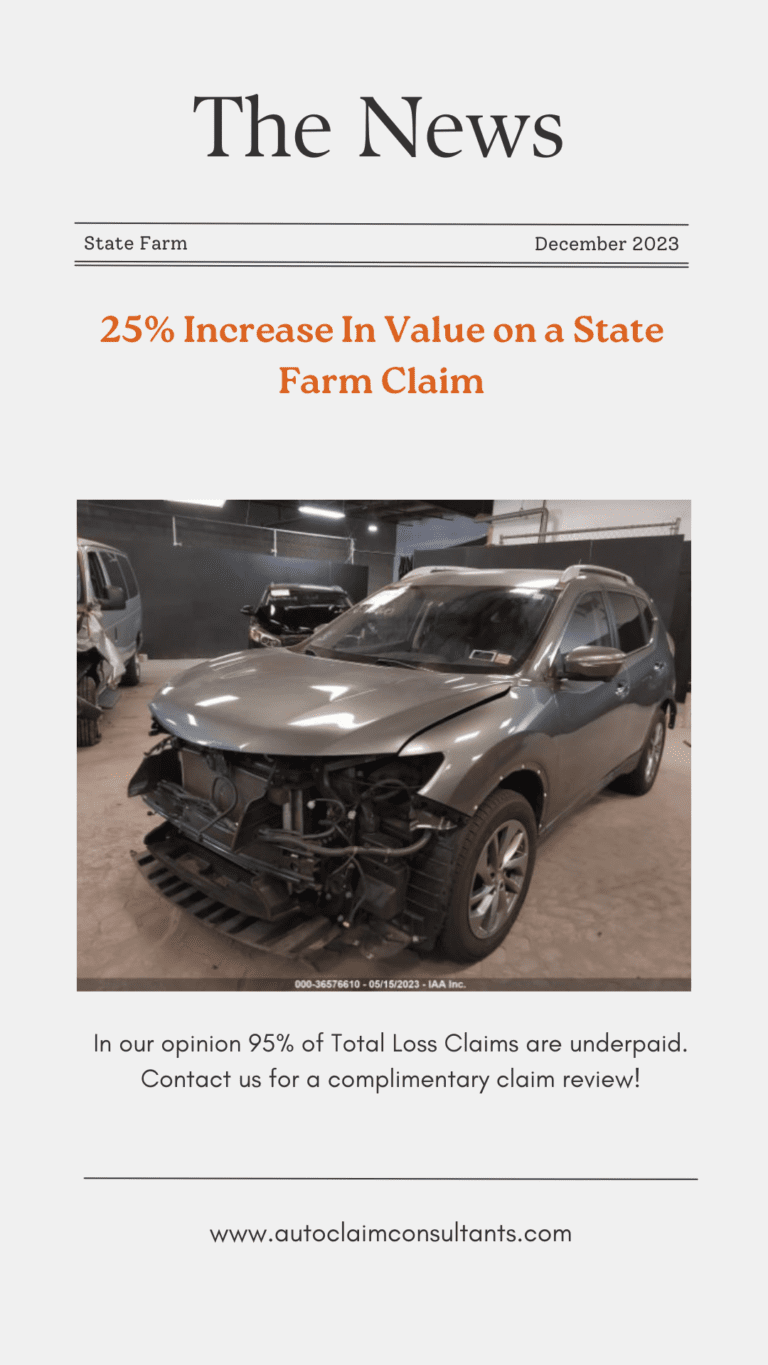

In a recent case involving a 2015 Nissan Rogue, our team at Auto Claim Consultants encountered a familiar challenge many vehicle owners face – an attempted underpayment by CCC and State Farm, a prominent player in the insurance industry. The situation unfolded when our client received a dishearteningly low valuation from CCC, setting the stage for a rigorous battle to ensure fair compensation.

**The Challenge: State Farm’s 25% Underpayment Attempt**

State Farm’s attempt to underpay our client’s total loss claim by a substantial 25% was a clear signal that navigating this insurance giant required strategic intervention. Recognizing the discrepancy between the actual value of the 2015 Nissan Rogue and the offered amount, our client sought our expertise to rectify the situation.

**CCC’s Role in the Valuation Dilemma**

Central to the challenge was the initial low valuation provided by CCC. As a widely used automotive valuation tool, CCC’s assessments significantly impact insurance settlements. In this case, the valuation misalignment spurred us into action. Armed with our expertise and commitment to fair compensation, we embarked on the journey to correct the undervaluation.

**Our Approach: A Right to Appraisal and Strategic Negotiations**

We initiated a right to appraisal on behalf of our client, a legal avenue that allows disputing parties to seek a fair and unbiased appraisal of the vehicle’s value. Armed with meticulously gathered evidence, we constructed a comprehensive appraisal and engaged in negotiations with State Farm’s hired appraiser. Check out our results.

**The Outcome: $3,314 More Than State Farm’s Offer**

Persistence, expertise, and strategic negotiation tactics ultimately yielded success. When the dust settled, our client walked away with a substantial $3,314 more than State Farm’s initial offer. This victory underscored the importance of seeking professional assistance when faced with undervaluation challenges, particularly in dealings with CCC and State Farm.

**The Takeaway: Why Auto Claim Consultants Matter**

This case serves as a testament to the crucial role Auto Claim Consultants play in ensuring fair compensation for vehicle owners. Navigating through the intricacies of CCC valuations and negotiating with insurance giants like State Farm requires a nuanced understanding of the process, legal avenues, and the commitment to securing the rightful value for our clients.

In conclusion, our recent triumph against State Farm’s underpayment attempt showcases the effectiveness of strategic intervention in total loss claims. For those navigating similar challenges with CCC and State Farm, remember – it pays to have a dedicated ally like Auto Claim Consultants by your side. Fair compensation is not just a goal; it’s a tangible outcome with the right expertise. 🚗💡 #TotalLossClaim #CCCValuation #StateFarmInsurance #FairCompensation #AutoClaimConsultantsSuccess”