How to Maximize Your USAA Diminished Value Claim

When you’re involved in a car accident, even after repairs, your vehicle may not retain its original market value. This loss in value, known as diminished value, can significantly affect your vehicle’s resale value. Fortunately, if you’re insured with USAA, you can file a diminished value claim to recover some of this lost value. Here’s how to maximize your USAA diminished value claim to ensure you receive the highest possible compensation.

Want to Maximize Your Diminished Value Claim Amount?

Understanding Diminished Value

Diminished value refers to the reduction in a vehicle’s market value after it has been involved in an accident and subsequently repaired. Buyers are often hesitant to purchase a vehicle with an accident history, which means it will sell for less than a similar vehicle with no such history. Insurance companies like USAA recognize this loss and offer compensation through diminished value claims.

Types of Diminished Value

There are three main types of diminished value:

- Immediate Diminished Value: This occurs immediately after an accident before any repairs are done. It’s the difference in value between your car before the accident and immediately after the accident.

- Inherent Diminished Value: This is the most commonly claimed type and refers to the loss of value due to the car’s accident history, even after it has been properly repaired.

- Repair-Related Diminished Value: This arises from substandard repairs or the use of non-original parts during the repair process.

For most USAA diminished value claims, inherent diminished value is the most common type.

7 Tips to Maximize Your USAA Diminished Value Claim

1. Gather Comprehensive Documentation

To substantiate your USAA diminished value claim, thorough documentation is crucial. This includes:

- Accident Report: Obtain a copy of the official accident report from the police or relevant authority.

- Repair Estimates and Receipts: Keep all estimates and receipts related to the repairs. This proves the extent of the damage and the quality of repairs.

- Photographic Evidence: Take clear photos of the damage before and after repairs.

- Vehicle Valuation Reports: Get a professional appraisal of your vehicle’s value before and after the accident.

2. Get a Professional Diminished Value Appraisal

A professional appraisal is vital in proving the diminished value of your vehicle. A certified appraiser can provide an unbiased evaluation of the lost value, which can significantly strengthen your claim. They use industry-standard methods to assess the impact of the accident on your vehicle’s market value, considering factors such as make, model, year, mileage, and pre-accident condition.

3. Understand Your Policy and State Laws

Not all insurance policies cover diminished value, and state laws vary regarding diminished value claims. Review your USAA policy to understand the coverage and consult with a local attorney or claims expert to ensure you’re aware of the laws in your state. Some states allow first-party diminished value claims, while others only permit third-party claims.

4. File Your Claim Promptly

Timing is crucial when filing a diminished value claim. The sooner you file after the accident, the stronger your case may be. Delaying your claim can make it more challenging to prove the pre-accident value of your vehicle and the extent of the loss.

5. Negotiate Effectively with USAA

Insurance companies, including USAA, may initially offer a lower amount than what you are entitled to. Be prepared to negotiate:

- Present Evidence: Use your documentation and professional appraisal to support your claim.

- Be Persistent: Don’t accept the first offer if it’s not fair. Be prepared to counteroffer and provide additional evidence if necessary.

- Seek Legal Advice: If negotiations stall, consider seeking legal advice. An attorney with experience in diminished value claims can offer guidance and support.

6. Consider Hiring a Public Adjuster

A public adjuster can handle the claims process on your behalf, ensuring all necessary documentation is submitted and negotiations are conducted professionally. Their expertise can be invaluable in maximizing your claim.

7. Utilize Online Resources and Tools

Several online resources and tools can help you understand and estimate your vehicle’s diminished value. These tools can provide a baseline estimate to help you understand the potential loss and support your claim.

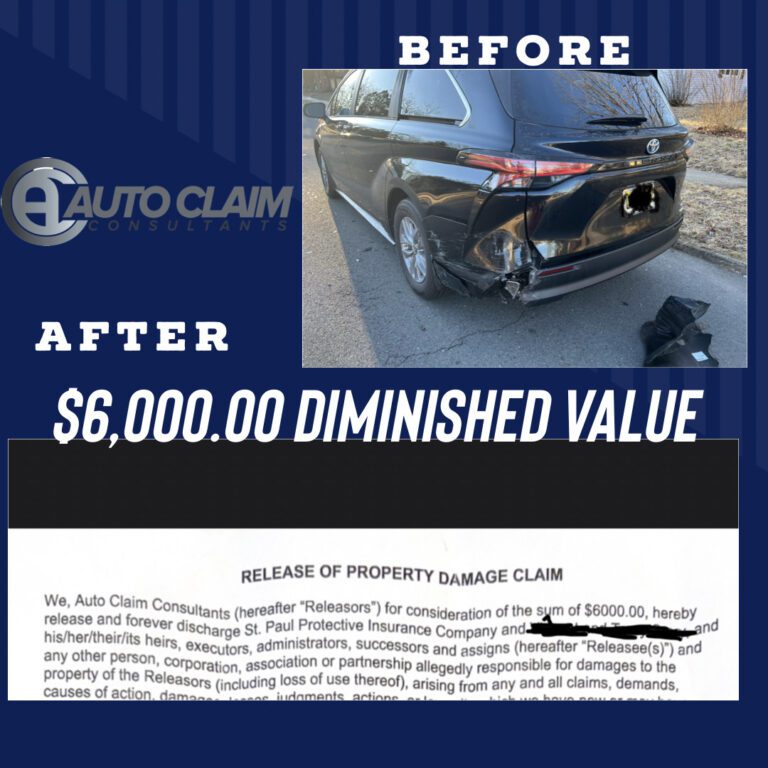

Contact Auto Claim Consultants for Help With Your USAA Diminished Value Claim

Maximizing your USAA diminished value claim requires diligence, thorough documentation, and effective negotiation. By understanding the types of diminished value, gathering comprehensive evidence, obtaining a professional appraisal, and being persistent in negotiations, you can increase your chances of receiving a fair payout.

Here at Auto Claim Consultants, we specialize in helping accident victims navigate the complex claims process to secure the highest possible compensation. Our team of experienced total loss appraisers can assist you in gathering evidence, negotiating with USAA, and ensuring you get the maximum payout for your diminished value claim. If you’ve been in an accident and are struggling to get a fair settlement from USAA, contact us today to get started or learn more about how we can help.

Your vehicle’s value matters, and we’re here to help you protect it. Reach out to Auto Claim Consultants now and let us guide you through the process to achieve the best possible outcome for your USAA diminished value claim.

FAQs

Does USAA cover diminished value claims?

USAA may cover diminished value claims depending on your policy and state laws. It’s essential to review your policy and consult with a claims expert to understand your coverage and eligibility.

How do I file a diminished value claim with USAA?

To file a diminished value claim with USAA, contact their claims department, provide comprehensive documentation including accident reports, repair receipts, and a professional appraisal of your vehicle’s value before and after the accident. Be prepared to negotiate the settlement offer.

What documentation do I need to support my diminished value claim?

You need the accident report, repair estimates and receipts, photographs of the damage and repairs, and a professional diminished value appraisal. These documents provide the necessary evidence to substantiate your claim.

How long do I have to file a diminished value claim with USAA?

The timeframe for filing a diminished value claim varies by state. Generally, it’s best to file as soon as possible after the accident to ensure all evidence is fresh and accurately reflects the vehicle’s condition.

Can I still file a diminished value claim if the accident was my fault?

Filing a diminished value claim when the accident is your fault depends on state laws and your specific insurance policy. Some states allow first-party diminished value claims, while others do not.

How is the amount of diminished value calculated?

Diminished value is typically calculated by assessing the vehicle’s pre-accident and post-repair market value. A professional appraiser uses industry-standard methods to determine the loss in value due to the accident.

What if USAA offers me less than the appraised diminished value?

If USAA offers less than the appraised diminished value, you can negotiate by presenting additional evidence and supporting documentation. Persistence and professional guidance can help you achieve a fairer settlement.