How to dispute an Insurance Company’s Total Loss Offer

December 20, 2022|

If you believe that the total loss value of your vehicle is incorrect, there are a few steps you can take to dispute the value.

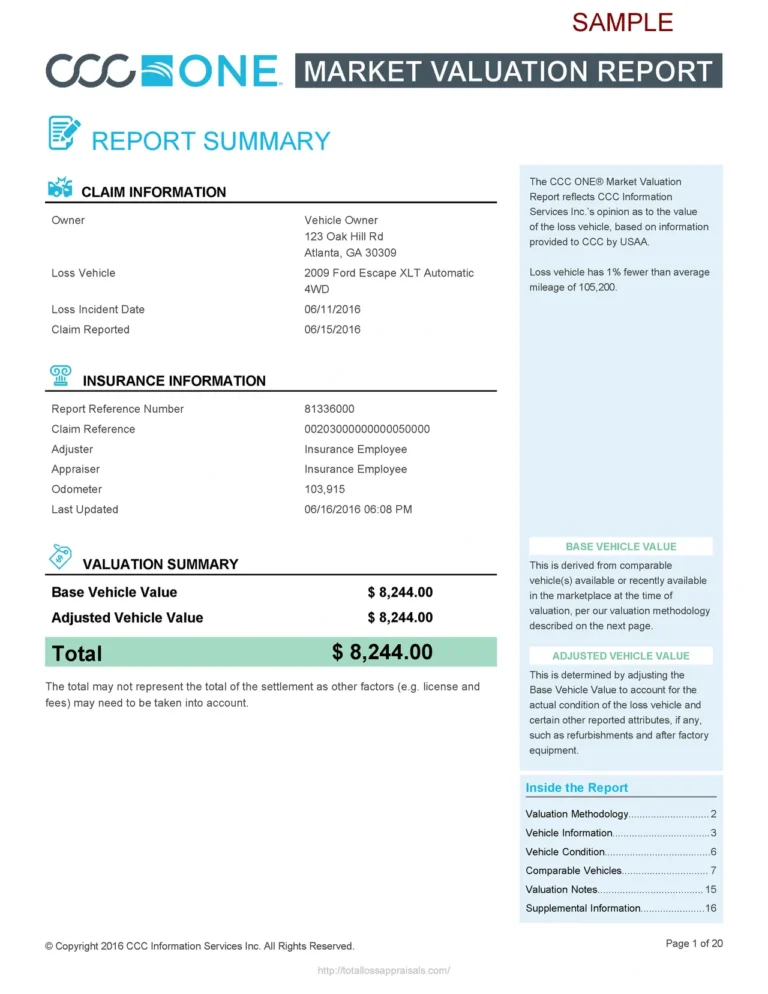

- Review the offer provided by the insurance company. This could be a report generated by either CCC, Mitchell, or Audatex. Check for any flaws or omissions.

- Gather evidence to support your claim: This could include receipts for recent repairs or upgrades, a professional appraisal, or a detailed list of the vehicle’s features and options.

- Contact your insurance company: Explain your position and provide any supporting evidence you have gathered. It may be helpful to have a copy of your policy and any relevant documentation on hand.

- Negotiate with the insurance company: If you are unable to reach an agreement with the insurance company, you may be able to negotiate a higher settlement by presenting a compelling case and leveraging any evidence you have gathered.

- Seek outside assistance: If you are unable to reach a resolution with the insurance company, you may want to consider seeking the assistance of an appraiser like Auto Claim Consultants.

It is important to keep in mind that the insurance company’s determination of a total loss value is based on a variety of factors, including the age and condition of the vehicle, the cost of repairs, and the value of the vehicle prior to the loss. If you are able to provide evidence that contradicts these factors, you may be able to successfully dispute the total loss value.